Weekly Outlook

U.S. higher PPI but lower CPI inflation leading to dollar weakening, U.K. job market cooling data, Gold uptrend, U.S. stocks gain, Canada’s and U.K.’s inflation ahead with RBNZ rate decision

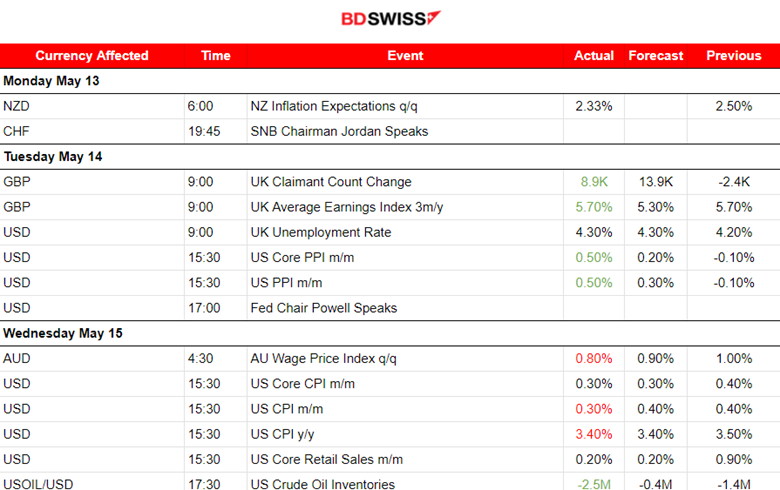

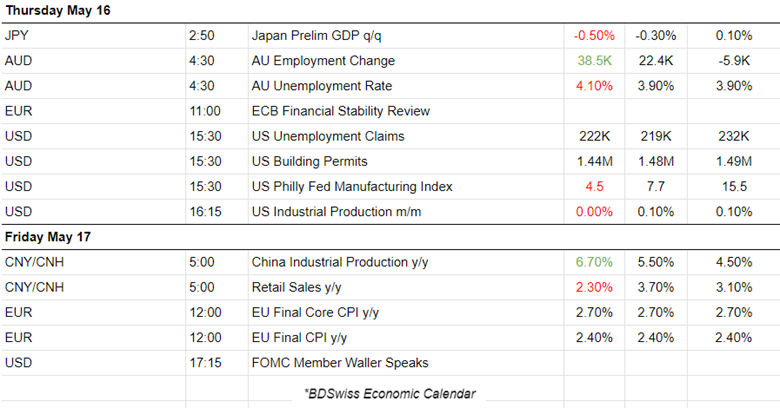

PREVIOUS WEEK’S EVENTS (Week 13-17.05.2024)

U.K. Economy

The latest UK labour market figures show that the labour market is cooling and that’s gradually translating into lower wage growth. The unemployment rate increased to 4.3%, British wages grew by a more than expected figure while other figures suggested the labour market is losing some of its inflationary heat. Regular wages, excluding bonuses, rose by 6.0% in the first three months of 2024 compared with the same period in 2023.

The Bank of England (BoE) said that the labour market remained tight by historical standards but the central bank could consider cutting rates over the summer. Last week, it signalled that it could start cutting rates from its current 16-year high of 5.25% as early as its meeting next month.

U.S. Economy

Jobless claims fell last week. Job growth is cooling and the number remains high enough to coincide with other relevant data. There are signs that the economy slowed further early in the second quarter as the delayed effects of the Federal Reserve’s interest rate hikes started to have a high impact. April’s economic data, including nonfarm payrolls and retail sales, have so far come in below economists’ expectations.

Goldman Sachs now expects the core PCE price index to have increased by 0.26% in April after rising 0.3% in March. It forecasts core inflation advancing 2.77% year-on-year, essentially matching March’s increase after rounding.

______________________________________________________________________

Inflation

U.S. PPI

The PPI report shook the markets when the U.S. producer prices increased more than expected in April, driven by services, indicating that inflation remained stubbornly high early in the second quarter.

Consumers feel the heat as higher production costs will feed into the inflation they see in the goods and services. The producer price index for final demand rose 0.5% last month. A 0.6% jump in services accounted for nearly three-quarters of the increase in the PPI. Inflation surged in the first quarter amid strong domestic demand after slowing for much of last year. Economists were optimistic that inflation will resume its downward trend this quarter as the labour market is cooling.

U.S. CPI

The U.S. CPI inflation figures release caused a shock as the figures were reported lower. CPI Inflation was reported less than expected in April, suggesting that it resumed its downward trend giving a boost to financial market expectations for a September interest rate cut. The CPI rose 0.3% last month after advancing 0.4% in March and February.

Retail sales were unexpectedly flat last month. The reports suggested that domestic demand was cooling which is favourable data for the Fed.

Annual inflation: In the 12 months through April, the CPI increased 3.4% after climbing 3.5% in March. The annual increase in consumer prices has slowed from a peak of 9.1% in June 2022. Inflation accelerated in the first quarter amid strong domestic demand after moderating for much of last year.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-producer-prices-increase-more-than-expected-april-2024-05-14/

https://www.reuters.com/world/uk/uk-regular-pay-grows-by-stronger-than-expected-60-2024-05-14

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 13-17.05.2024)

Server Time / Timezone EEST (UTC+02:00)

Currency Markets Impact:

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The U.S. dollar index experienced weakness since the 14th of May after the release of the PPI figures. The figures were actually reported higher and despite the initial reaction of dollar appreciation, the market’s view was future dollar weakening. U.S. CPI news on the 15th confirmed that a cooling inflation indication caused further and heavy dollar weakening with the dollar index dropping to the support at near 104.10. On the 16th of May, the index retraced to the upside and back to the 30-period MA. Further U.S. economic data were showing an economic slowdown putting pressure on the dollar to remain low.

EURUSD

EURUSD

This pair moved to the upside quite apparently due to dollar depreciation. U.S. Inflation news was showing signs that inflation has the potential for cooling and putting a stop to its recent acceleration. The EUR is leaning more towards depreciation as inflation data show a favourable yearly 2.4% figure very close to target causing a rise in expectations for an interest rate cut soon. The ECB policymakers will likely start cutting interest rates from a record high in June according to their latest meeting. The dollar weakening though might continue as further data support the economy’s slowdown and inflation cooling would likely keep the EURUSD at a high steady level for now.

USDJPY

USDJPY

The dollar weakened significantly after the U.S. inflation-relevant data releases bringing the USDJPY to the downside. This drop took place also because of the recent JPY strengthening (look at JPY pairs such as EURJPY and GBPJPY) that started on the 14th until the 16th of May. The dollar started to appreciate on the 16th and the JPY started to show weakness again causing pairs (JPY as quote) to move significantly higher.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin enthusiasts are now gaining confidence that Bitcoin is returning to the upside. The CPI news obviously triggered the jump. As mentioned in our analysis last time, retracement followed eventually with Bitcoin returning to the 61.8 Fibo level before again moving upwards.

On the 17th of May, the price moved upwards eventually, crossing over the 67K USD level but remained close. Since that day a consolidation phase took place with the 30-period MA to turn sideways and the mean to remain at 67K USD. The price tested that resistance many times without success. It might do that this week with Bitcoin potentially reaching the next resistance at near 70K USD.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

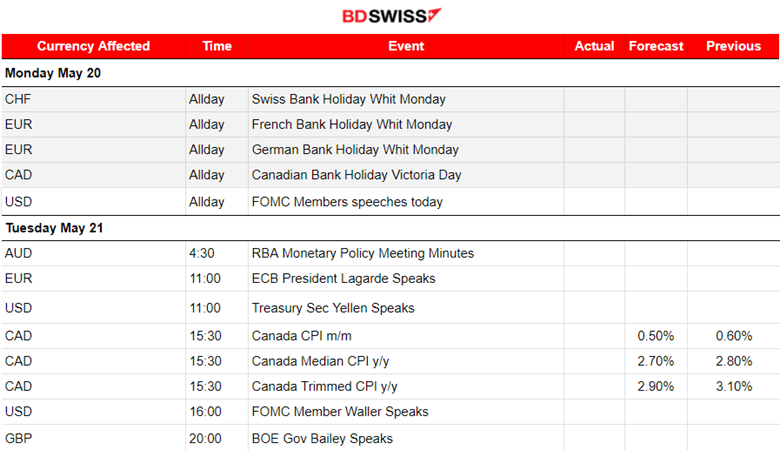

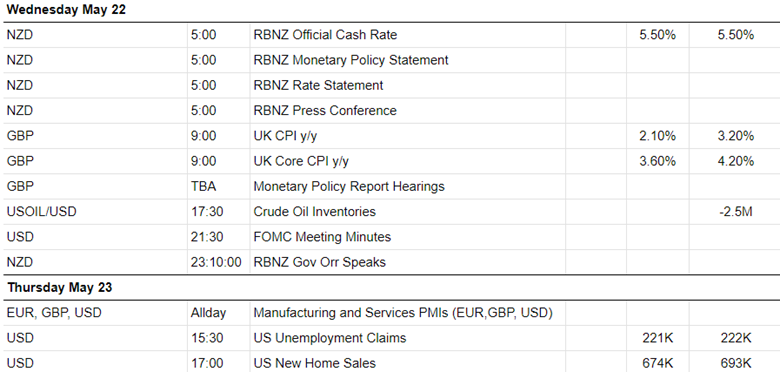

NEXT WEEK’S EVENTS (Week 20 – 24.05.2024)

Coming up:

-Central Bank representatives speak this week, and lots of scheduled speeches take place.

-Canada’s and U.K.’s inflation data releases.

-RBNZ will decide on rates.

-Retail sales and Durable goods data releases.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

On the 14th of May, the PPI news caused its price to drop and test again the support at near 77.40 USD/b before it eventually retraced to the 30-period MA. On the 15th of May Crude oil broke the support at near 77.40 USD/b and moved lower near the support at 76.40 USD/b before it reversed to the upside. During the U.S. CPI news volatility levels grew with Crude oil to experience first a fall and then a full reversal. It crossed the 30-period MA moving rapidly to the resistance near 78.78 USD/b and a retracement took place as predicted in our previous analysis back to the 61.8 Fibo. After the news on the 16th of May, Crude oil started a steady path to the upside remaining above the MA. This path looks like an upward wedge, if not a channel, that the price now follows as it moves to the upside and a potential opportunity to trade upon breakout.

Gold (XAUUSD)

Gold (XAUUSD)

On the 14th of May, the support held and the price reversed to the upside correcting from the drop. Gold crossed the MA on its way up and moved higher to the resistance at 2,360 USD/oz. The dollar weakening helped gold to stay higher. After the release of the U.S. CPI news on the 15th of May, Gold jumped higher following the USD’s depreciation, reaching the resistance at near 2,397 USD/oz. Retracement followed as mentioned in our previous analysis, reaching 2,372 USD/oz.

The unemployment claims figures did not have much impact on the 16th of May. USD strengthening caused this drop in the price of Gold. After the retracement, it remained stable and close to the MA.

On the 17th of May, Gold moved to the upside after gaining strong momentum confirming the continuation of an uptrend. Iran’s hardliner President Ebrahim Raisi was killed in a helicopter crash, the country’s state media has said. On Monday, the Iranian Red Crescent confirmed the bodies of the president and others who died in the crash having some bullish impact on Gold. The demand for bullion assets was further bolstered by heightened military action between Russia and Ukraine. Both nations launched strikes against one another over the weekend. The fundamentals continue to point to a bullish trend for the near future.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

The PPI news on the 14th of May caused a breakout of the support near 5,211 USD causing the index to drop to 5,195 USD before it reversed immediately to the upside. This happened due to the dollar effect, we saw that the dollar index reversed immediately as well to the downside at that time. The level 5,240 USD was quite significant for resistance and that was broken on the 14th of May after the index’s continuation to the upside. The other indices experienced similar paths. On the 15th of May, the U.S. CPI report caused dollar depreciation and a jump in U.S. stocks. On the 16th of May, the index moved upwards again until it found strong resistance that marked the reversal to the downside. Dollar strengthening and not-so-interesting unemployment claims figures pushed the index to cross the 30-period MA and to settle at the 61.8 Fibo level. On the 17th of May, the index moved with low volatility on the sideways and around the MA with a mean at 5,300 USD.

______________________________________________________________