Weekly Outlook

The End of Euphoria

There’s been a sudden change in the mood in the markets. Bond yields and inflation expectations have been declining for some time now, but the trend accelerated sharply in the last few days.

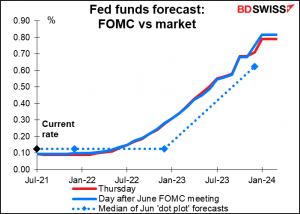

The Fed isn’t behind this one – fed funds expectations are virtually unchanged from right after the June 16 meeting of the Federal Open Market Committee (FOMC).

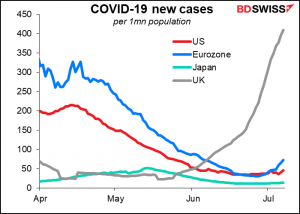

What’s going on? The main thing seems to me to be the sudden increase of new virus cases as the new, more virulent delta variant spreads rapidly. The UK is the worst example, but there are others too – Spain has increased 3.6x in the last 10 days, while here in Cyprus, we hit a record 962 cases Wednesday – over 10x the level of just a month ago.

And while the numbers are still low in many places compared with what they were at the beginning of the year…

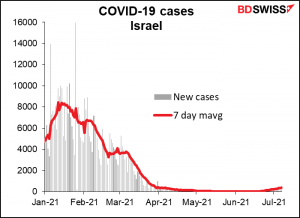

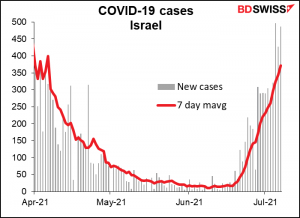

…by now everyone is familiar with the concept of “exponential growth.” It’s even a worry in Israel, the country with one of the highest (and earliest) vaccination rates in the world.

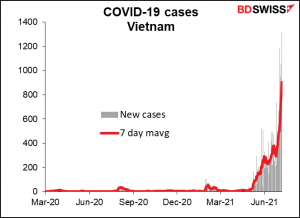

Another cautionary tale is Vietnam. The country managed to keep the virus under lock and key until recently. At the end of April it had had fewer than 3,000 cases total. Now with the new variant it’s averaging 800-900 new cases a day.

This suggests that in contrast to the optimism earlier in the year about how vaccines were going to rescue us, it now looks like the virus will be with us for some time to come – that far from reaching “herd immunity,” we may be in for yet another global wave when the winter comes and activity goes back indoors.

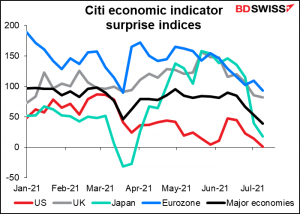

At the same time, the surprise at the speed of the recovery has started to wear off. Part of that is because market expectations have increased…

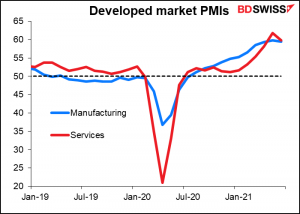

…and part is because the “V”-shaped recovery has hit the right-hand edge of the “V”. The latest manufacturing purchasing managers’ index (PMI) fell slightly (to 59.5 from 59.8) while the service-sector PMI was down more notably (59.8 from 61.8). That doesn’t mean the global economy is grinding to a halt by any means, but it just means that the period of the most rapid expansion is probably over.

The significant point about the decline in the service-sector PMI is that while the service sector took the biggest hit during the pandemic, probably there isn’t as much pent-up demand for services as there is for goods. That is, if you missed your vacation last year, you probably won’t take two vacations this year to make up for it. You won’t go out to dinner twice as much to make up for all the restaurant dinners you missed, or get your suit cleaned twice as often. Demand may return to normal levels, but there won’t be the same sort of surge to abnormally high levels that there was for some manufactured goods, such as the car rental companies rebuilding their fleets. We may be approaching “peak personal demand.”

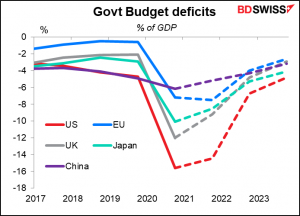

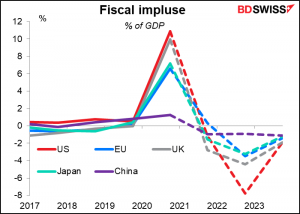

Meanwhile, governments are starting to rein in their budget deficits. While deficits will probably be wider than usual this year and next, they won’t approach the levels of 2020 again any time soon.

That means the “fiscal impulse” – the contribution to growth coming from additional fiscal spending – will be negative for the next two years. It’s not the size of the deficit that matters for growth, but rather the change from one period to another. In this case, the deficits will be shrinking, and that means governments’ contributions to growth will be contractionary even as they run a stimulative fiscal policy (just not as stimulative as in the previous year).

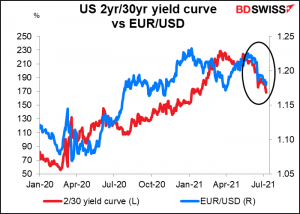

The idea that demand from both the personal and government sectors may be peaking could be why bond yields have been coming down so quickly. They’ve been coming down faster than inflation expectations, which are still elevated because of supply-chain bottlenecks that are likely to last for some time. That has caused a steep drop in US real yields. Surprisingly, this hasn’t hurt the dollar at all – quite the contrary. This is a big break from the recent trend.

The move does however fit in nicely with the move in the US yield curve. A flattening yield curve may be an indicator of difficult times to come and a “safe-haven” bid for the dollar.

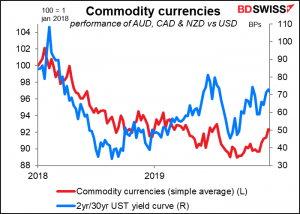

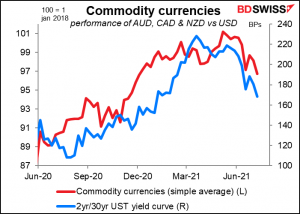

A flattening US yield curve would also tend to be negative for the commodity currencies if it signals lowered growth expectations.

Next week: busy, busy, busy

Last week the title of my weekly was “Bored on the Fourth of July,” because the week looked to be so boring (I didn’t expect the ECB strategy review to end so suddenly). This week however is going to be “Whole Lotta Shakin’ Goin’ On.” The weekend features a G20 finance ministers and central bankers meeting in Venice. There are three major central bank meetings during the week: New Zealand and Canada on Wednesday, Japan on Friday. Fed Chair Powell gives his semi-annual testimony to Congress. And the US consumer price index comes out on Tuesday, among numerous other key indicators from the US, Japan, China, and the UK. Busy busy busy!

The G20 meeting will attract a lot of press, and there will of course be any number of bigwigs there giving press conferences or interviews. Yet the topics they’ll be focusing on aren’t the main issues for the FX market nowadays: corporate taxes, climate change, and vaccines. There may be some discussion about debt relief for emerging market countries, but not usually the ones whose currencies are actively traded by retail accounts.

Central bank meetings: BoJ, RBNZ, BoC

These three central bank meetings are likely to lack much excitement. I certainly don’t expect any change in policy at any of them. They will all include new sets of quarterly forecasts. The main thing to watch will be what the revised forecasts are. Do they still think that the recent rise in inflation will be temporary? What’s their view on growth? Are they encouraged by vaccines or worried by the new variants?

RBNZ: more concern about inflation?

The RBNZ is likely to keep both its official cash rate (OCR) and its large-scale asset purchase (LSAP) program unchanged. The main question is what changes if any do they make to the forecasts in their quarterly Monetary Policy Statement (MPS).

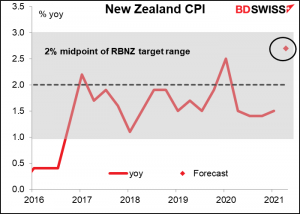

Q2 CPI comes out on Friday; I don’t know if they’ll have the data in time for Wednesday’s meeting, but the forecast is for a leap to 2.7% yoy, near the top of their 1%-3% target band. That’s higher than anticipated in the April MPS, which said they expected inflation to peak at around 2.6% in the near term. Moreover they said they expected this level to be transitory and for inflation to fall below 2% next year “and only return to the midpoint of the target range over the medium term as capacity pressures emerge more sustainably.”

This dovish sentiment could change, however. The New Zealand Institute of Economic Research (NZIER) Quarterly Survey of Business Opinion, released earlier this week, showed inflationary pressures increasing. “…labour shortages and supply chain disruptions are leading to a further build-up of capacity pressures across the New Zealand economy. The increase in both costs and prices points to rising inflation pressures…” NZIER said.

I expect the RBNZ to be somewhat more hawkish about inflation as a result.

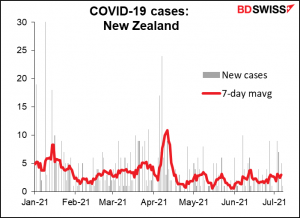

On the other hand, they can’t be too hawkish, because the slow progress of vaccination and their “zero tolerance” policy has left the country vulnerable to any uptick in virus cases, which would cause an immediate lockdown (so far no problem, but no one can afford to relax).

On balance I would expect no change in policy but a more hawkish outlook with regards to inflation, which could give NZD a boost.

Bank of Canada: sluggish growth = no change

This is the month for a new edition of the quarterly Monetary Policy Report (MPR). The BoC’s policy guidance at its June meeting read

We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank’s April projection, this happens sometime in the second half of 2022

The question then is, has anything happened in the interim to make them think that it might happen sooner or later than they thought back then?

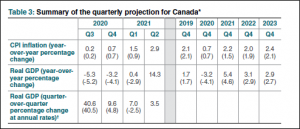

Here are the projections from the April MPR.

Q1 GDP came in at 5.6% qoq SAAR, significantly below their estimate. This didn’t phase them; they said in June that “While this was lower than the Bank had projected, the underlying details indicate rising confidence and resilient demand.” But Q2 GDP is also forecast to come in substantially below what they had expected. (Unfortunately I can’t find forecasts for the yoy rate to compare forecasts further out.)

Moreover, the unemployment rate at 8.2% remains stubbornly high and indeed is going in the wrong direction, while the labor force employment rate (persons in employment as a percentage of the working-age population) has also failed to recover.

Inflation on the other hand is expected to be higher than what the BoC thinks; the market forecast for Q4 this year is 2.9% yoy, vs the MPR forecast of 2.2%, and 2.2% in Q2 2022, vs 2.0% for the official forecast. However, I’d say that right now, most central banks are more worried about sustaining growth than they are about not overshooting their inflation targets.

Looking at the employment picture, it seems to me that it’s going to be some time before the “economic slack” is absorbed.

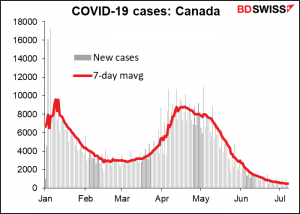

The BoC can perhaps be more optimistic than some other central banks because the virus is not surging there as it is elsewhere. While they may upgrade their forecasts somewhat in the MPR, I would expect the statement following the meeting to remain pretty much as it is and for the forward guidance to remain essentially unchanged. That could put some downward pressure on CAD.

Bank of Japan: no change, as usual

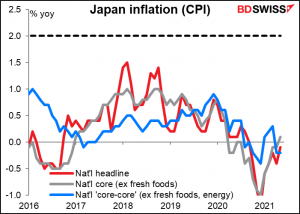

As for the Bank of Japan (BoJ), it’s committed to keeping policy steady during the remainder of the Anthropocene Epoch or until the Rapture occurs, whichever comes first. With the headline CPI remaining in deflation thanks to cuts in mobile phone charges and Japan’s vaccination program lagging far behind the rest of the developed world, there’s little chance of the Bank even “thinking about thinking about” normalizing policy any time soon. Nobody in their right mind looks for any significant policy change at this meeting or indeed any other meeting in the foreseeable future.

One thing on the agenda: at the previous meeting in June, the BoJ decided to lend money to financial institutions to on-lend for projects to address climate change. It will unveil the preliminary outline of the scheme at this meeting before launching it later in the year.

Also, there’s a new Board member, former Nomura Asset Manager CEO Junko Nakagawa. She doesn’t seem to have a particularly dovish or hawkish stance, but rather her views in her inaugural press conference were in line with the BoJ’s current stance. Another boring rubber stamp operator for Gov. Kuroda to push around, apparently.

Bloomberg reported that the Outlook Report (Outlook for Economic Activity and Prices) will raise the forecast for inflation in the current fiscal year(04/21-03/22). But since they won’t change policy, I question how important that is.

In other central bank news, Fed Chair Powell will make his semi-annual trip to the Capitol to testify on monetary policy. He’ll speak to the House Financial Committee on Wednesday and the Senate on Thursday. I’m sure he’ll be grilled about inflation, about bond purchases, and about the recovery. Usually he just sticks to his well-known script, but there could be some off-the-cuff remark in response to the many many questions that he gets.

The indicators

The main indicator of the week is the US consumer price index (CPI) on Tuesday. It’s not the Fed’s preferred inflation gauge; that’s the personal consumption expenditure (PCE) deflator. However it is the market’s preferred inflation gauge; investors seem to take more note of it than they do of the PCE deflators. (If you want to understand the difference between the two, I’ve written a piece explaining it. It’s available on our website here.) Thus this is a key indicator for the markets.

The headline figure is expected to fall by 10 bps, while the core figure is forecast to advance by 20 bps. The market seems to pay more attention to the headline figure than to the core figure though so the fact that it backs off from 5% yoy may be significant. The mom rate of increase is also expected to fall a bit to +0.5% mom from +0.6%. This could encourage investors to think that the worst is over for inflation, it is indeed likely to be transitory as the Fed has been saying, and there’s no urgency to tighten policy any time soon. That would be good for stocks. The impact on the dollar is harder to say. Recently the dollar has been acting as a “safe haven currency,” along with the yen, which suggests that it might cause the dollar to weaken. On the other hand, we discussed above how a stronger dollar goes along with lower US rates and a flatter US yield curve. That means it could push the dollar higher, too.

This isn’t the only US inflation data out during the week; the producer price index (PPI) will be released on Wednesday. (For a discussion of the relationship between the PPI and the CPI, see The PPI and the CPI: what’s the connection?

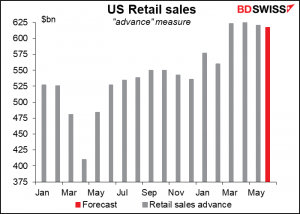

The other major US indicator due out during the week is retail sales on Friday. It’s expected to be down mom again as the impact of the March supplementary payment continues to fade.

We’ll have to get used to weak retail sales figures from now. Even after two months of decline, retail sales are expected to be 17.2% above the pre-pandemic average. This just isn’t normal. As supplementary unemployment insurance fades from the scene and incomes come back to normal, it’s likely that retail sales will come back to normal, too. This is what I was talking about above: as the fiscal boost fades, the burden of supporting the economy falls on the consumer, who may well be unemployed still. That could be a challenge for growth prospects in the future.

Other major US indicators out during the week include the Fed’s Beige Book on Wednesday, the Empire State and Philly Fed indices on Thursday, and the U of Michigan consumer sentiment index on Friday.

Britain announces its CPI on Wednesday and employment data on Thursday. Headline inflation is expected to move a bit above the Bank of England’s 2% target. This will come as no surprise to the Bank of England, which said last month that “CPI inflation is expected to pick up further above the target, owing primarily to developments in energy and other commodity prices, and is likely to exceed 3% for a temporary period… the Committee’s central expectation is that the economy will experience a temporary period of strong GDP growth and above-target CPI inflation, after which growth and inflation will fall back.” So while higher inflation may be temporarily positive for the pound, I doubt if it will weigh on the Bank of England’s decision at its August 5th meeting.

Especially since the unemployment rate is expected to show no improvement.

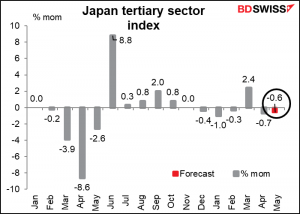

Japan announces its machinery orders and corporate goods price index on Monday and tertiary sector index on Thursday. I’m not sure how much these will affect the yen however. It seems to me that the currency is far more dominated by global risk sentiment than it is by domestic factors.

That being said, I think the tertiary sector index could attract some attention.

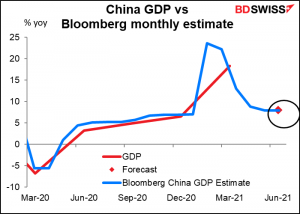

China has a number of important indicators out during the week, including trade (Tue) and the usual retail sales, industrial production, and fixed asset investment on Thur, this time with the crucial GDP figure. It’s expected to come in at around 1.0% qoq or 8.0% yoy, which is returning to normal after over a year of pandemic-induced distortions.

Other important indicators out during the week include EU industrial production (Wed), Australia employment (Thu), and New Zealand CPI (Fri).