Technical Analysis Post

Microsoft Corporation (NASDAQ: MSFT) Q3 EARNINGS: Forecast, Analysis, and Strategic Insights

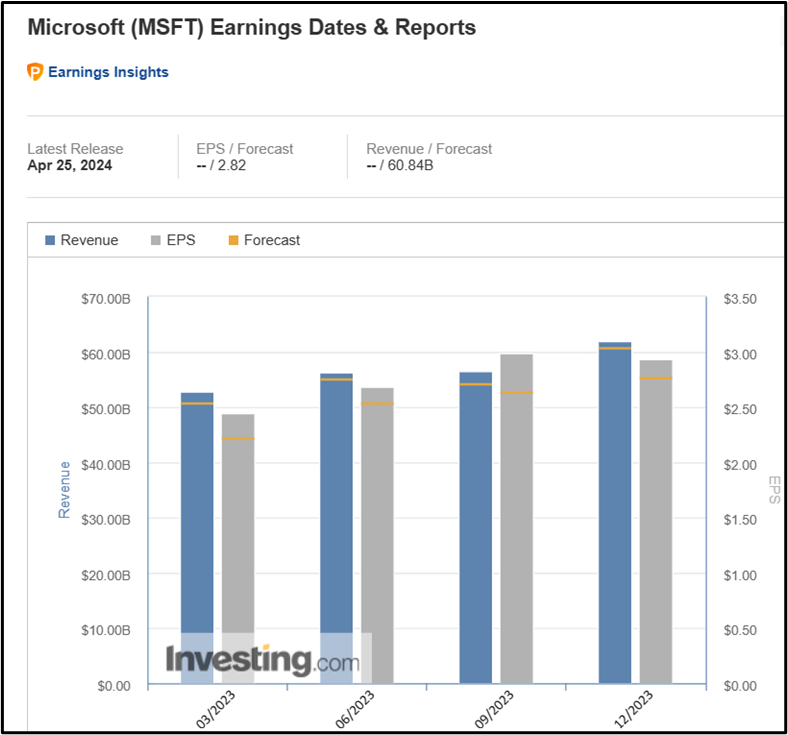

Microsoft Corporation is scheduled to release its fiscal year 2024 third-quarter financial results after the market closes on Thursday, April 25, 2024. You can access the announcement on the

Microsoft Investor Relations website at https://www.microsoft.com/en-us/Investor/. Additionally, a live webcast of the earnings conference call will be available at 2:30 p.m. Pacific Time.

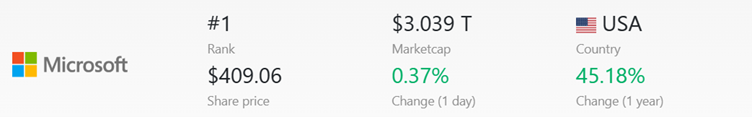

As of April 2024, Microsoft’s market capitalization stands at $3.039 trillion, positioning it as the world’s most valuable company by market cap, based on data from companiesmarketcap.com

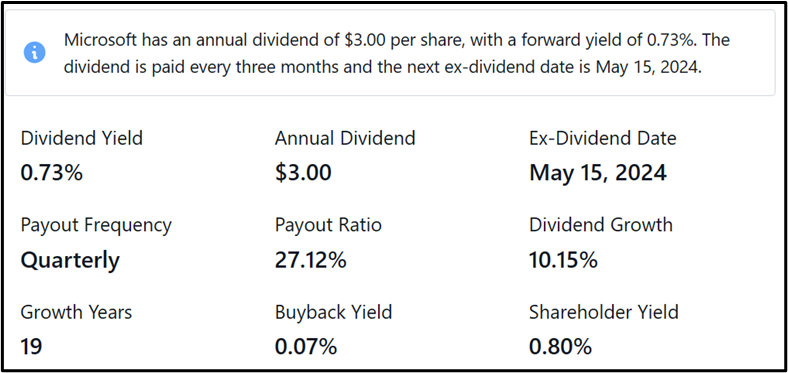

Microsoft Dividend Information Microsoft Corporation offers an annual dividend of $3.00 per share, yielding 0.73%. The dividend is paid quarterly, with the next ex-dividend date set for May 15, 2024. Additionally, the company has a payout ratio of 27.12%, dividend growth of 10.15%, and a shareholder yield of 0.80%.

Microsoft Corporation offers an annual dividend of $3.00 per share, yielding 0.73%. The dividend is paid quarterly, with the next ex-dividend date set for May 15, 2024. Additionally, the company has a payout ratio of 27.12%, dividend growth of 10.15%, and a shareholder yield of 0.80%.

Recent Developments At Microsoft

Microsoft invests $1.5 billion in Abu Dhabi’s G42 to accelerate AI development and global expansion.

Microsoft invests $1.5 billion in Abu Dhabi’s G42 to accelerate AI development and global expansion.

G42, a prominent artificial intelligence (AI) technology holding company based in the UAE, and Microsoft Corporation revealed a significant development on April 16, 2024. Microsoft announced a strategic investment of $1.5 billion in G42. This investment aims to enhance collaboration between the two entities in implementing the latest Microsoft AI technologies and skilling initiatives not only in the UAE but also in various countries worldwide. As part of this deepened partnership, Brad Smith, Vice Chair and President of Microsoft, will assume a position on the G42 Board of Directors.

Cloud Software Group and Microsoft sign an eight-year strategic partnership to bring joint cloud solutions and generative AI to more than 100 million people.

Cloud Software Group Inc. and Microsoft Corp. have revealed on April 4, 2024, their plans to enhance their collaboration with an eight-year strategic partnership agreement. This agreement aims to bolster the go-to-market collaboration for the Citrix® virtual application and desktop platform, while also facilitating the creation of new cloud and AI solutions through an integrated product roadmap. Furthermore, Cloud Software Group will invest $1.65 billion in the Microsoft cloud and its generative AI capabilities.

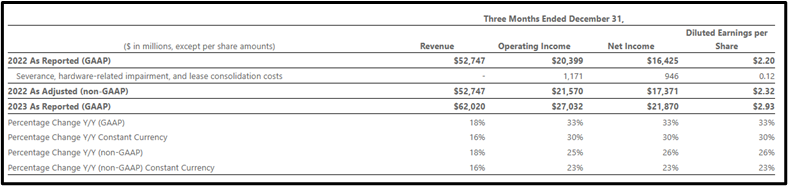

2024 Q2 Recap of Earnings Release On January 30, 2024, Microsoft Corp. released the following results for the quarter ending December 31, 2023, compared to the same period of the previous fiscal year:

On January 30, 2024, Microsoft Corp. released the following results for the quarter ending December 31, 2023, compared to the same period of the previous fiscal year:

Revenue reached $62.0 billion, marking an 18% increase (16% in constant currency).

Operating income amounted to $27.0 billion, reflecting a 33% increase, with a 25% increase in non-GAAP figures (23% in constant currency).

Net income stood at $21.9 billion, showing a 33% increase, with a 26% increase in non-GAAP figures (23% in constant currency).

Diluted earnings per share reached $2.93, marking a 33% increase, with a 26% increase in non-GAAP figures (23% in constant currency).

2024 Q3 Earnings Release Analyst Forecast

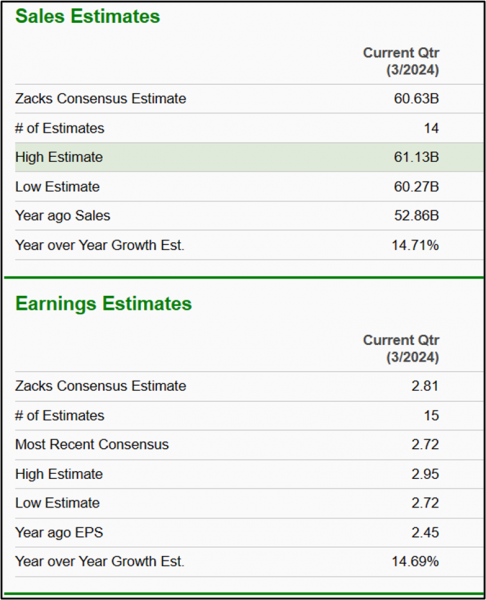

In the current quarter, the Zacks Consensus Estimate for sales is $60.63B, with a high estimate of $61.13B and a low estimate of $60.27B, based on 14 estimates. The year-over-year growth is anticipated to be 14.71%, compared to last year’s sales of $52.86B.

Shifting to earnings, the Zacks Consensus Estimate is $2.81 for the current quarter, derived from 15 estimates. The most recent consensus is $2.72, with a high earnings estimate of $2.95 and a low estimate of $2.72. Last year’s EPS was $2.45, with a projected year-over-year growth of 14.69%.

According to Investing.com, Microsoft Corporation (NASDAQ: MSFT) is expected to achieve an earnings per share (EPS) of $2.82, with an estimated revenue of $60.84 billion.

According to Investing.com, Microsoft Corporation (NASDAQ: MSFT) is expected to achieve an earnings per share (EPS) of $2.82, with an estimated revenue of $60.84 billion.

According to TradingView.com, the anticipated earnings per share (EPS) for Microsoft Corporation (NASDAQ: MSFT) is projected to be $2.82, with an expected revenue of $60.86 billion.

According to TradingView.com, the anticipated earnings per share (EPS) for Microsoft Corporation (NASDAQ: MSFT) is projected to be $2.82, with an expected revenue of $60.86 billion.

Technical Analysis Analyzing Microsoft Corp. (NASDAQ: MSFT) on the 4-hour chart reveals a consistent range-bound movement between $430.91, acting as the current resistance, and $398.47, serving as the current support since March 6, 2024. Presently, the price hovers around $408.84 post a rejection from the support level. A sustained rejection at this support level suggests a probable upward movement towards the resistance. Conversely, a breakdown below the support level indicates a potential downward trend. Breaking above the resistance level signals a likely further uptrend, while a rejection at this level suggests a potential downturn towards the support level.

Analyzing Microsoft Corp. (NASDAQ: MSFT) on the 4-hour chart reveals a consistent range-bound movement between $430.91, acting as the current resistance, and $398.47, serving as the current support since March 6, 2024. Presently, the price hovers around $408.84 post a rejection from the support level. A sustained rejection at this support level suggests a probable upward movement towards the resistance. Conversely, a breakdown below the support level indicates a potential downward trend. Breaking above the resistance level signals a likely further uptrend, while a rejection at this level suggests a potential downturn towards the support level.

Conclusion

In conclusion, Microsoft Corporation is gearing up to release its fiscal year 2024 third-quarter financial results, with analysts forecasting a positive earnings per share (EPS) and revenue. Recent strategic investments and partnerships indicate the company’s commitment to innovation and expansion, particularly in the realms of artificial intelligence (AI) and cloud solutions. From a technical analysis perspective, the stock exhibits a range-bound movement, with clear resistance and support levels dictating potential future trends.

Sources

Microsoft Fiscal Year 2024 Third Quarter Earnings Conference Call

Microsoft (MSFT) – Market capitalization (companiesmarketcap.com)

Microsoft Corporation (MSFT) Dividend History, Dates & Yield – Stock Analysis

Microsoft Türkiye’ye Yeni Ajans | Pazarlamasyon

FY24 Q2 – Press Releases – Investor Relations – Microsoft

MSFT: Microsoft – Detailed Earnings Estimates – Zacks.com

Microsoft (MSFT) Earnings Dates & Reports – Investing.com

MSFT Forecast — Price Target — Prediction for 2025 (tradingview.com)